What do you think of when you hear the term “Cost Reduction” in the manufacturing industry? There may be such things as elimination of waste in the workplace or price negotiations with suppliers. Cost reduction is said to be important, but it may be difficult to imagine what impact cost reduction has on business management. Cost reduction is important, but it is difficult to understand the effects and to know whether it is effective or not. In fact, there are many cases where cost reduction is not only ineffective but also leads to higher costs because of falling in pitfalls.

This article introduces how to reduce costs with Toyota Business Practice. You will understand the whole picture of cost reductions in the manufacturing industry based on my actual experience at Toyota in Japan and overseas as well as startups. The suppliers I am introducing here are mainly small and medium-sized companies engaged in metal processing. I myself work with local SMEs in various countries. These SMEs taught me a lot about manufacturing with passion and challenges they have. I aim for coexistence and co-prosperity with SMEs.

Cost reduction is processes to improve your company’s profits. These processes reduce the cost of producing and selling products or services. To increase profit, Reducing cost of goods and services is generally easier to control than increasing sales. This is because increasing sales depends on the economic circumstances and customer choices, while costs are always incurred and are easier to control. However, there is little information available on why and how to reduce costs, so there are cases where companies fall into the following pitfalls

Here is an explanation of how to avoid the pitfalls.

To begin with, why cost reduction? Cost reduction improves profit margin and generates advantages.

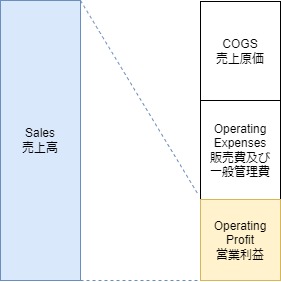

The profit margin is the ratio of profit derived from sales minus costs of goods sold (COGS) and Selling, general and administrative expenses (Operating Expenses), divided by sales. The higher the profit margin, the greater the percentage of profit derived from sales, and the higher the profitability of your company.

As the profit margin increases, more profit is earned even from the same sales levels. The more profit yields the 3 advantages below.

There are two types of cost reduction. This article focuses on 2). About 1), besides activities of 2), you will reduce cost as much as possible to balance your company in the black, regardless of comparisons with other companies.

1) Emergency cost reductions to get out of the red

2) Cost reductions during normal times when your company is in the black but still needs to realize the following three benefits

As profits increase, the financial strength of your company is strengthened. A stronger financial position reduces the risk of bankruptcy and increases corporate sustainability.

Specifically, as profits increase, your company’s retained earnings increase. Retained earnings form a part of your company’s equity capital. Therefore, as profits increase, the equity ratio increases. The equity ratio is an indicator of the ratio of a company’s equity capital. The higher the equity ratio, the more stable a company’s financial position is considered to be.

Also, even if the business environment changes due to a recession or natural disaster, a large profit surplus increases the likelihood that the company will be able to restructure and continue its business.

As profits increase, your company can expand its size and market share.

Profits can be used to develop new products and services, find new customer segments, and increase sales. Similarly, through overseas expansion and mergers and acquisitions, your company can aim to further expand its size and market share.

Fostering growth is also beneficial to your company’s employees and shareholders. For employees, new employment opportunities, career advancement opportunities, and salary will increase. For shareholders, corporate value increases as a result of corporate growth, leading to shareholder returns.

From profits, you can differentiate yourselves from your competitors and gain a competitive advantage in the marketplace.

Profits can be used to invest in R&D and manufacturing to provide products and services that are superior to those of competitors and meet customer needs. Investments in marketing strengthen the brand.

For example, by using profits, you can invest in production efficiency improvement, you can further reduce your costs more than your competitors. By keeping costs down, you can gain an edge in price competition and differentiate yourself from your competitors.

Cost reduction methods can be broadly divided into the following four steps: (1) cost visualization, (2) priority sequencing, (3) cost reduction activity planning, and (4) progress management and PDCA. As a note here, we have not set a target amount for total cost. Since targets can be set for various reasons and perspectives, this section only introduces various cost reduction methods. In reality, we aim to achieve the target by multiplying various cost reduction activities with certainty (100%, 50%, and 20% achievable).

Rather than tackling cost reduction from the top of your mind, it is important to step back and look at cost structures from the big picture. Of course, the area of cost that you should look at may differ depending on the size of the company. However, it is still important to first grasp the overall picture of costs related to the business, product, or unit you are in charge of. Specifically, check how much of the cost is in the following items in terms of absolute values and percentages.

What is complicated here is that costs from an accounting perspective and a manufacturing perspective get mixed up. Here, we will first organize the cost breakdown from the accounting perspective. The following is the breakdown of costs.

Strictly speaking, cost of sales does not count inventory and varies from period to period, but for the sake of simplicity, we will assume that inventory is also counted in the costs.

| Category | Sub-Category | Details & Examples |

|---|---|---|

| General and Administrative Cost | Executive Compensation | Compensation paid to Executives |

| Salary and Wage | Employee salaries and bonuses | |

| Miscellaneous Wage | Salaries and bonuses to part-timers | |

| Statutory Benefit Fee | Cost of health insurance and other benefits | |

| Welfare Expense | Expenses for employee benefits such as medical examinations and congratulatory and condolence expenses | |

| Repair Expense | Maintenance costs for offices etc. | |

| Outsourcing Fee | Expenses incurred due to outsourcing, such as design fees | |

| Utility Expense | Water, gas, electricity | |

| Rent Expense | Office rent and parking lot ground rent | |

| Expendables | Office supplies | |

| Transportation Expenses | Commuting and travel expenses | |

| Communication Expenses | Telephone and Internet usage fees | |

| Taxes and Dues | Taxes and fees for issuing official documents | |

| Insurance Premium | Damage insurance premiums on company-owned property | |

| Vehicle Expenses | Costs associated with gasoline and vehicle maintenance | |

| Lease Fee | Lease expenses for copiers and other equipment | |

| Book & Subscription Expenses | Cost of books and newspapers purchased by the business | |

| Member Dues | Membership dues such as union dues and commercial association dues | |

| Commissions expense | Advisory fees to specialists and bank transfer fees | |

| Depreciation | Non-manufacturing depreciation | |

| Selling Expenses | Advertising expenses | Web Advertising |

| Flyer Advertising | ||

| Sales commission | Individual Sales Agent | |

| Distributor as Sales Agent | ||

| Packing Freight | Shipping Fee | |

| Promotion Expense | Sample Cost | |

| Campaign Discount | ||

| Entertainment Expense | Entertainment expenses | |

| Condolence and Congratulatory expenses | ||

| Transportation Expense | Trains | |

| Car Fuels | ||

| Cost of Goods Sold assumed the same as Manufacturing Cost | Direct Cost | Raw Material A |

| Raw Material B | ||

| Raw Material C | ||

| Component D | ||

| Component E | ||

| Component F | ||

| Direct labor (Production) | ||

| Indirect labor (Logistics, Quality Control) | ||

| Indirect Cost | Manufacturing Equipment Depreciation | |

| Manufacturing Building Depreciation | ||

| Electricity Expenses | ||

| Gas Expenses | ||

| Maintenance Supplies | ||

| Repair and Maintenance | ||

| Rent | ||

| Insurance |

It’s crucial to use relative metrics to determine whether a cost is high or low. Simply comparing the amount is insufficient. Here are some useful metrics for cost comparison, along with their advantages and disadvantages, listed in order of ease of use:

- Year-over-Year Comparison (YoY) (Comparison with different years)

- Comparison with other factories within your company or related companies

- Comparison with listed company’s annual reports within the same business field

- For World wide companies’ analysis, Dun & Bradstreet provides financial data

- For Japanese companies’ analysis, TDB (Teikoku Data Bank) or Tokyo Chamber of Commerce and Industry Research Unit provides financial data of wide range of Japanese companies (Fees of 30-60USD necessary).

- Comparison with other companies within the same business field based on your Tax accountant information (the accuracy of information depends on individual tax accountant)

- Comparison with other companies within the same business field based on your client buyer information (It requires customers to agree to cooperate, build trust that data will not be misused, etc.)

After cost comparison of (1), you will know which costs are relatively high for your company. The next step is to prioritize cost reduction. Prioritizing by importance, urgency, and expansion trend (future prospect to increase the cost) will lead to effective cost reduction activities.

The following is an example of prioritization from the perspective of the company as a whole, but of course it can also be verified on a product, project, or plant basis.

| Cost Item | Importance | Urgency | Expansion Trend | Priority |

|---|---|---|---|---|

| Raw Materials & Components | High : 70% of total cost, 20% higher than industry average | Middle : Large cost increase due to supply shortage | High : Increasing trend in material costs due to inflation | 1 |

| Direct Labor | Middle : 20% of total cost, 10% higher than industry average | Middle : Temporary staffing due to labor shortage | Middle : Expanding trend over the past few years | 2 |

| Electricity Expenses | Low : Less than 10% of total cost | High : Large cost increase | Middle : Increasing trend due to inflation | 3 |

| Gas Expenses | Low : Less than 10% of total cost | High : Large cost increase | Middle : Increasing trend due to inflation | 3 |

Next, for each cost item, we investigate bottlenecks (classification of problems) for individual materials and components that have particularly high cost weight. Specifically, each cost item is further broken down into smaller pieces.

For example, in the case of raw material and component costs, we break down each type of material and component by “material unit cost (USD/kg) x input weight (kg/piece) x yield ratio (%, ratio of product weight to input weight; calculated as product weight divided by input weight). Therefore, it is possible to compare not only the unit cost of materials but also the yield ratio with other companies in the same industry to see if there is any room for improvement. It is difficult to know if there are any issues with your company’s material unit cost or yield ratio. The only way to find out is to interview customers, new material suppliers, and other companies in the same industry.

As another example, manufacturing labor costs can be broken down as follows: number of workers (persons) x unit labor cost (USD/hour) x average working hours (hours/person). We would like to reduce the number of workers and unit labor cost last. The average working hours can be decomposed as follows. Average working hours = number of working days x (8 hours regular working hours + average overtime and holiday working hours). From there, the first step is to reduce overtime and holiday work hours. Another approach is to measure only the “value added work,” which is the time required for substantial processing, such as opening bolts and tightening nuts, to determine the time required to change the shape of the product. You will be surprised there is so much other time, such as walking time in the factory and waiting time for processing machines. You can sort necessary time (value added time), necessary yet to reduce (typically in-house logistics), and truly unnecessary time (waiting time to finish machining etc.). In the case of cost reduction of the company as a whole, we will consider the time required for project management.

In the case of a company-wide cost reduction project, the project may be very large, so it may be a good idea to assign roles from this point on. For example, procurement for materials and components, mechanical engineers for yield ratio, and so on. Prioritizing the roles among them would be effective and clarify the scope of responsibility.

Once prioritized, cost reduction activities are more effective if they can be performed by a team rather than by one person. In order to share information with others, it is easy to understand if you specify clear objectives, specifically the gap between “what should be” and “what as is” in quantitative terms.

| Item | Should be | As is | GAP |

|---|---|---|---|

| Who | Procurement | Procurement | None |

| What | Raw Material A, B, C | Raw Material A, B, C | None |

| When | Always | Always | None |

| Where | domestically | domestically | None |

| How | Purchases at the market price | Purchases at +30% over market price | +30% |

Once prioritized, you can plan cost reduction activities. Before suddenly coming up with a cost reduction plan, it is important to investigate the true cause of the high cost.

As a precaution, the cause of the bottleneck is investigated in depth by repeatedly asking “why” until the true cause is identified (this is called “why-why analysis”. Sometimes books require “five (5) whys” or investigate the reasons of reasons for five times. However, there is no need to force the process to be analyzed five times. It is also important to consider the bottleneck as a problem in the system, rather than attributing it to a person. If the problem is caused by a person, there is a high possibility that it will recur, so a mechanism must prevent recurrence instead of a person.

Once the true cause is identified, a countermeasure plan is developed and implemented. It is common that what we believe true cause are not true cause or mistakes. Therefore, it is important to assume that we will try and error many times.

Also, if you draft a schedule of “by when” and “what to do” here, you can manage and share progress. It is tempting to rush to achieve results, but a schedule with a little leeway will allow activities to be carried out without strain. The true cause of the problem may be different or delayed because of trouble-shooting.

Once a plan has been made, then you will manage the progress. It is effective to have regular progress checks. One method of checking progress is called “Obeya (large room) activities”. Paper materials summarizing the progress of various Cost Reduction activities are posted along the walls in one meeting room, and the leader and the person in charge report and consult with each other on a regular basis.

In this digital age, digitization of documents is in favor, but putting up paper documents only for Obeya activities is recommended. We will promote cost reduction by creating a system for mandatory visualization and reporting of progress as a key point. There is a website introducing Obeya activities in details (reference).

The following items can be incorporated into your cost reduction efforts to make them more effective.

- To prevent quality problems, thoroughly define quality standards and evaluate new ideas

- Company-wide, department-wide, and project-wide efforts (leadership by key persons such as CEO)

- Continuous efforts (long-term activities, such as one year)

- Measure the effects and make improvements (Obeya activity helps to visualize the progress)

- Incorporate into personnel assessments (In Japan, there is a small compensation based on improvement / Kaizen proposals. Some European companies adopt a percentage-based compensation based on the amount of reduction).

In particular, with regard to the personnel assessments, if the assessments are based solely on the amount of Cost Reduction, there is Cost Reduction might be prioritized over quality and safety. In Japan, it is not common to have a compensation system based on individual performance, much less a percentage-based compensation system.

From our past experience in cost reduction, we have learned the following as a mechanism for cost reduction. If you find it difficult to carry out all of these activities on your own, you can consult with local Chamber of Commerce and Industry or the local government, which will be able to assist you in various ways. Experienced consultants often do this on a commission basis (we can also introduce you to several companies).

- The biggest cost reduction is possible during the development period. After the product is commercialized, there is less flexibility for design changes.

- Similarly, cost reduction through price negotiation is most possible when multiple suppliers are competing for orders. Once the supplier and purchase price have been determined, there is little incentive from the supplier’s perspective to negotiate prices.

- In each country, there is a law to protect suppliers (US : Service Contract Act, UK : Small Business, Enterprise and Employment Act, Germany : Unternehmensgesetzbuch, Japan : Subcontract Act etc.) For such laws, reducing price after an order might be illegal.

- If there are price competitiveness issues within your company or with your suppliers (e.g., your cost at a certain process is higher than competitors etc.), plan how to resolve them. In some cases, this may be a long-term issue.

- Rapid cost reduction may cause quality and production issues. However, it also depends on the way of thinking. If small-scale improvements to the production line or control software can be quickly reversed even if problems arise, a quick changeover will be effective.

- If a company purchases a large volume of the same parts over a long period of time, such as an automobile manufacturer, it is important to set up regular price negotiations to explore price competitiveness issues that should be addressed to reduce costs as a built-in mechanism. In addition, it is possible to encourage suppliers to improve their production efficiency by gradually resolving issues over multiple sessions, rather than resolving them in a single session (e.g., half a year). On the buyer’s side, it is also important to support the suppliers to avoid excessive burdens on the suppliers. Buyers are encouraged to assist suppliers to become more efficient by sharing know-hows or expertise.

- It is also true that there is “a room size” for cost reduction. In general, technologically newer components and manufacturing methods have a larger cost reduction room. The easier it is to add value, the easier it is to sell at a higher price. Conversely, more conventional components are harder to add value and increase efficiency so that there is a smaller cost reduction room. When negotiating prices, it is important to take into account the cost reduction room sizes.

- Cost reductions without evidence at the above regular price negotiations may strangle you in the long run. If you continue to negotiate prices without actual cost reductions (without cost reductions within the supplier), leaving the buying power (your company = the size of the buyer’s purchase) to the supplier, only the supplier’s gross profit will decrease over the long term, and the supplier will be unable to make new capital investments, develop technologies, or at worst, continue its business, which will cause risks for the supplier’s product development capabilities and business continuity.

- The previously introduced mechanisms such as Self Procurement and Customer Supply are not only done by a single company, but multiple companies can collaborate in the same industry or region.

- It is a great advantage for your company to incorporate Cost Reduction mindset into your corporate culture, compensation, and personnel assessments.

- (In cases where regular price negotiations are not being conducted), buyer can support the cost reduction activities of suppliers and share the half of the cost reduction amount costs. 50% of cost reduction amount is a return to buyer. 50% of cost reduction amount is return for suppliers. Suppliers will be motivated rather than one-sided cost reductions.

- (In the case of regular price negotiation) Suppliers would accept a request of cost reduction if they are dependent on the buyers (a high percentage of sales are made to the buyer). Buyers are encouraged to work together with suppliers as partners to resolve the cost competitiveness issues.

Enserve offers the following points of view to each company. If there is anything we can do to help you, we would be happy to discuss it with you.