For Small / Medium Enterprises (SME), it is often challenging to consider costs and regulations for an import / export project of Metal or Metal-made products. In this article, we would introduce issues to consider and some of the pitfalls that SME often overlook. If you wish to jump into the specific topic, you can refer from the table of the contents.

There are basically two aspects to consider before import / export your goods. One is about cost (import / export taxes) and regulartions.

| # | Issue | Place | Cost / Regulation |

|---|---|---|---|

| 1 | Cost | Export Country | VAT |

| 2 | Cost | Export Country | Export Duty |

| 3 | Cost | Export Country | License fee |

| 4 | Cost | Import Country | Importy Duty |

| 5 | Cost | Import Country | VAT or similar sorts |

| 6 | Cost | Import Country | License fee |

| 7 | Regulation | Export Country | Basic Restriction on Export Items |

| 8 | Regulation | Export Country | Temporary Restriction on Export Items |

| 9 | Regulation | Import Country | Basic Restriction on Import Items |

| 10 | Regulation | Import Country | Termporary Restriction on Import Items |

Description

For export, VAT (Value Added Tax or genral tax for goods and sevices) are usually not charged or VAT refund may be available. Still some countries require every shipping company to charge VAT for both domestic and export sales.

Comment

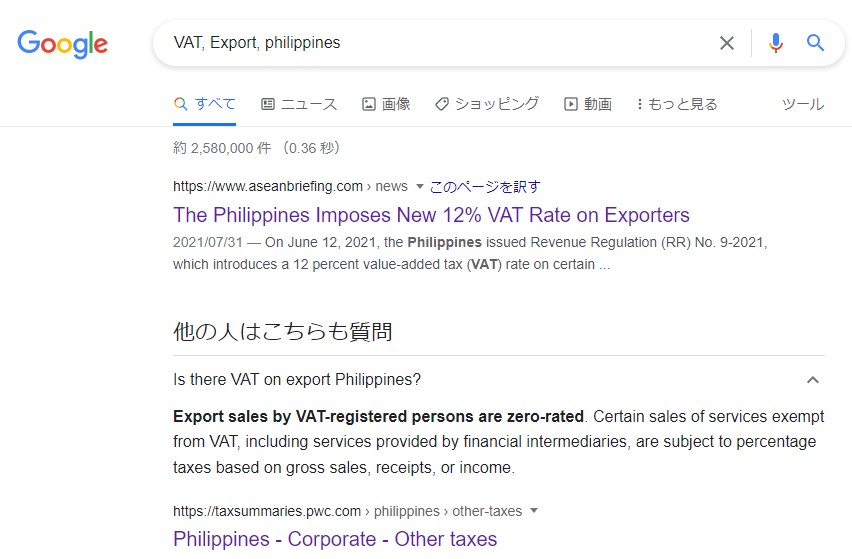

You can search on google such as “VAT, Export, Country Name (like Philippines)” like the screenshot below. You can consult with exporting company or contact exporting country’s Trade Support Organization (like JETRO for Japan).

Description

Sometimes export duty is charged if exporting country wishes to keep the exporting material for domestic use (We have seen cases in steel and grains).

Comment

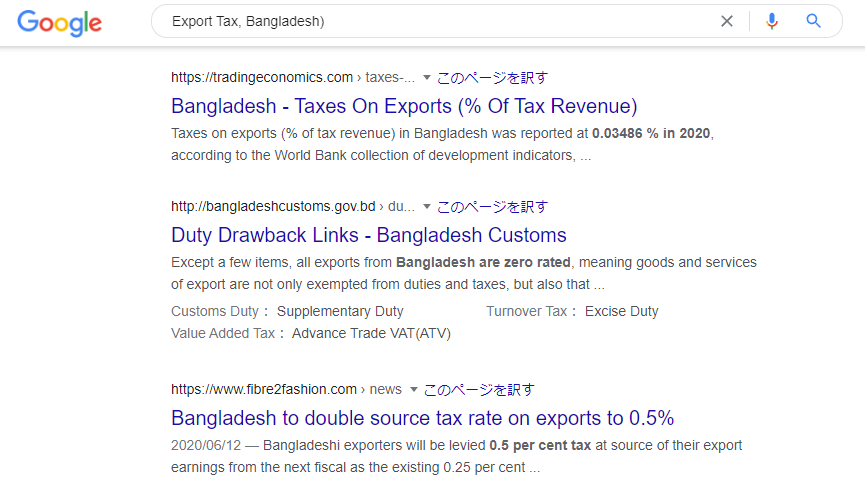

Export tax applies sometimes in emerging countries. You can first search on google such as “Export Tax (or Duty), Country Name (eg. Bangladesh)” like the screenshot below. Along with VAT, you can consult with exporting company or contact exporting country’s Trade Support Organization (like JETRO for Japan).

Description

Some countries require license to export and custom clearance. If your exporting manufacturing supplier does not own the license, you may need to purchase through export licensed company. This means extra cost is charged.

Comment

If an exporting country requires the export license, usually, large manufacturing companies own the license. Small ones may not so that you may need to purchase through a licensed company.

Description

Importy Duty may be charged on importing items.

Comment

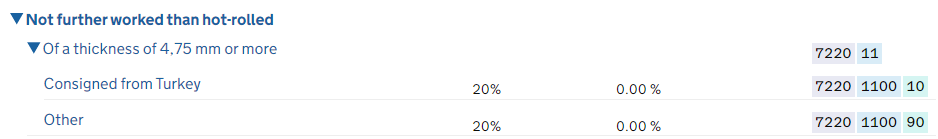

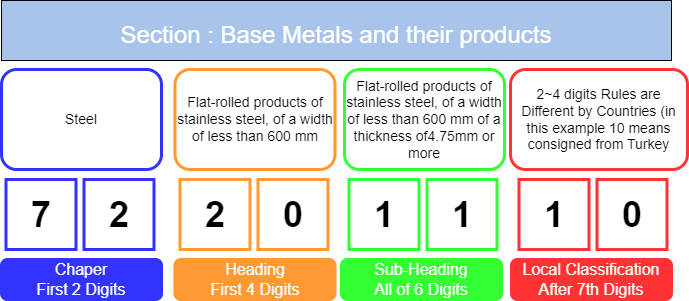

There are two steps to confirm the import duty of importing country. First, you can check with the import country HS code. HS code is Code numbers established in accordance with the International Convention on the Harmonized Commodity Description and Coding System (HS Convention). It consists of 6 digit numbers. All of HS codes are classified by all tradable items ino 21 sections. The initial 6 digit is the universally same across the countries. The first two digits are called “Chapter (Broad category)”, the first four digits including the Chapter are called “Heading (Middle category)”, and the all of six digits including the Heading are called “Sub-heading (Detail category)”. There are additional 2~4 digitis varying by countries (called Local Classification or Statistical Classification). So you may need to check for export country. Below is an example of UK HS code. Then you can check the tariff rate associated with the HS code. Please be careful for calculating the import duty cost. The import duty is calculated by CIF Price x Tariff rate. CIF includes product price + logistics cost + insurance fee. The import duty must include the logistics cost. The tariff rate may be reduced if there is EPA (Economic Partnership Agreement) between export and import countries.

Description

Even though custom is not charged, practically VAT is applied to all of importing goods.

Comment

Technically not VAT, but practically similar to VAT is charged upon importing. VAT is calculated by (CIF Price + custom cost) x VAT rate or CIF Price x (1+Tariff rate) x (1+VAT rate). Global VAT compliance shows a list of VATs.

Description

Some countries require license to import. It may require some fees to obtain the license.

Comment

License owner can be either importing party or other parties (trade company / importing company / a third party). You can consult with importing partner to obtain the license first. We had an experience that the import license itself was a privilege. The license was protected by current license owners and practically impossible for new players in the market to obtain the license. So we recommend to check if your team can obtain the license.

Description

There are universal export restrictions by international agreements or individual countries. For metal products, items for miliatary weapons may be restricted. For these materials,exporting party may need to prepare a proof document (It is called Parameter sheet in Japan) that the application of exporting item does not violate such regulations.

Comment

The basic restrictions of Japan are 1) ~5) below. For metal products, 4) would be the main concern.

1) Items for which domestic demand supplies need to be secured (eg. blood products, formula feed, some animals)

2) Trade Orderly Substances (eg. fishing vessels with fishing equipment)

3) Items that may harm a society (eg. counterfeit currency, drags, contents harmful to public morals)

4) Items that are banned by International Agreements (eg. military weapons, nuclear fuels, endangered animals)

5) Intellectual property infringing goods (eg. counterfeit products)

We recommend you to search the export country restrictions for “export, country name, restrictions, product name / category”.

Description

There are temporary export restrictions to protect exporting country economy or impose economic sanctions.

Comment

For example, Export of nickel ore, a raw material for the production of lithium-ion batteries, is restricted in Indonesia. Indonesia’s intention is to smelt nickel ore at home and export it (with added value). Also, recently, NVIDIA has been banned by the U.S. government from exporting to China. The U.S. government’s regulation is cited as a security reason. If you handle metals or chemicals that depend heavily on few sources and may affect general public, you may face this restrictions. This is difficult to foresee. We recommend you to find multiple sources other than current country, if you believe that the current country is less stable in terms of trade policies / geopoilitical risk / natural disaster risk etc. Also as technological progress, the restricted item suddenly looses its value. For example, a rare metal was essential for coating (surface treatment) of automotie components. The rare metal had a risk of export restriction for political reasons. Then, a new coating method was developed without the rare metal. After the development, the demand for exporting the rare metal decreased drastically.

Description

There are universal import restrictions by international agreements and idividual country policies. For metal products, items for miliatary weapons may be restricted. For these materials, the importing party may need to prepare approval before actual product arrival.

Comment

The basic restrictions are 1) ~7) below. For metal products, 1), 2), 6), and 7)would be the main concern.

1) Trade Orderly Substances (eg. fishing vessels with fishing equipment)

2) Items that may harm a society (eg. counterfeit currency, drags, contents harmful to public morals)

3) Items that are banned by International Agreements (eg. military weapons, nuclear fuels, endangered animals)

4) Intellectual property infringing goods (eg. counterfeit products)

5) Items that may harm the safety of consumers (eg. products subject to PSE, Radio Act, CCC, UL etc)

6) General Import Restrictions (eg. India BIS, Indonesia import license, Iraq designated certificate of origin etc)

7) Logistics related Restrictions (Regulation of wood packaging material in international trade etc)

For metal products, you may need to check . You can google each topics such as “import, country name, restrictions”. Otherwise, you can consult with your forwarder.

Description

There are temporary restrictions to protect importing country economy or impose economic sanctions.

Comment

An emerging economy may restrict import of some goods to protect their economies. For example, you cannot import electrical power goods (plugs, chargers, lithium-ion batteries etc) in China. We observe that the Chinese government encourages export of such goods and discourages any import. Similarly, western countries impose economic sanctions to certain countries by restricting import from the sanctioned counties. Some emerging country is not allowed to import certain kinds of steel due to anti-dumping concerns.This kind of restrictions takes place suddenly due to political reasons. You can check the latest restrictions by checking the news and the import country’s official website. Since certain exporting countries are sometimes subject to restrictions, it is also useful to be able to procure from multiple countries.

There are many pit falls for international businesses. Despite your effort and investment you might not be able to commercialize or violate the rules required by export / import countries. I hope you refer to at least above 10 points before jumping into the actual transaction. If you have question or concerns, please do not hesitatet to consult us.